Despite a dip in exports last season, the popularity of table grapes is still growing

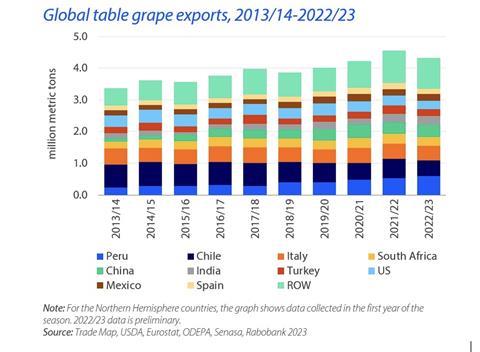

Global table grape exports dipped last season, but the industry remain on an upward growth trajectory according to a recent report by Rabobank.

It notes that supply countries grappling with challenges like climate change and rising costs are striving for efficiency improvements, while on the consumption side, demand for green seedless varieties continues to increase.

Despite a 5 per cent fall in global exports in 2022/23, many countries are adjusting their production to meet demand and enhance operational efficiency.

Gonzalo Salinas, senior analyst – fresh produce commented: “This was the second-highest global table grape export season in history, only surpassed by the previous 2021/22 season. We expect the upward trend in exports observed over the past decade to continue in the coming years”.

Weather irregularities are among the biggest challenges facing key suppliers in different regions. Chile saw an 18 per cent export decline due to extensive uprooting of low-yielding areas and other profitability-enhancing efforts over the past ten seasons.

Meanwhile, Peru emerged as the largest exporter last season, shipping nearly 600,000 tonnes of grapes, despite logistical disruptions caused by political protests earlier this year.

Rabobank noted that rising prices in primary destination markets are shifting the retail landscape, favouring green seedless varieties. “While some markets witness a slight grape availability decline, controlled upward growth is expected,” Salinas said.

When it comes to the future, Rabobank predicts that the variety mix will lean toward green rather than red grapes. Proprietary varieties, with higher yields, lower costs per kilogram, and improved quality will be at the forefront of the supply line in the forthcoming seasons, benefiting both producers and retailers, the report said.