New Rabobank report finds that some exporters continue to grow, despite higher costs due to the pandemic, climate change, and logistics hurdles

Vegetables have become more expensive to produce, but strong consumer demand and declining production in key markets of North America and Europe have opened new opportunities for major suppliers including Mexico, Spain, Netherlands, Turkey and Poland.

Those are among the headline findings contained in a new report published by Rabobank and timed to coincide with the publication of its latest World Vegetable Map.

The map, which is updated every few years, charts recent trends in vegetable production, consumption and trade worldwide.

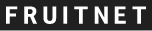

According to the new analysis, the value of the global vegetable market remains below the hundred billion-dollar peak it achieved for the first and only time in 2021. However, its average 3 per cent annual growth between 2017 and 2022 kept sales in line with inflation.

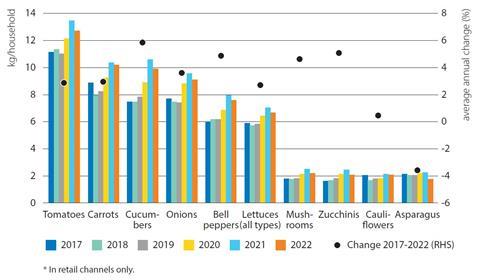

Production in the EU and the US both saw declines over the same period, but consumption is said to have held up relatively well, despite higher costs for consumers and producers alike.

During that time, Mexico’s fresh vegetable exports increased by 40 per cent, growth which Rabobank said was driven largely by bigger demand for greenhouse-grown produce in the US.

“The past five years have been everything but boring for the vegetable sector,” says Cindy van Rijswick, the group’s global strategist – fresh produce. “The Covid-19 pandemic, extreme weather events, skyrocketing costs for growers, and challenging logistics are just some of the factors that have impacted the sector.”

At its height in 2021, the global trade in vegetables was valued at US$107bn. What’s remarkable is the fact that only 7 per cent of the world’s vegetables are sold outside their country of origin, and even that small proportion is sold mainly within continents and often between neighbouring countries.

Global vegetable production has grown at a slower pace compared with sales, according to the report, at 1.2 per cent per year over the same five-year timescale.

New players emerge

“Since 2017, the US has further cemented its position as the world’s largest import market for fresh vegetables, with a significant share of imports for greenhouse vegetables like cucumbers, tomatoes, and bell peppers,” Van Rijswick notes. “This has led to a nearly 40 per cent increase in Mexico’s total fresh vegetable exports between 2017 and 2022.”

While Mexico, Spain, and the Netherlands were already big players in the world of fresh vegetables, other sources of supply have expanded their sales.

“Countries such as Turkey and Poland are becoming bigger producers and exporters of both fresh and processed vegetables,” Van Rijswick adds.

Poland in particular has evolved as both an importer and exporter, reflecting its growing significance as a central European trading hub. Meanwhile, in the processed vegetable market, China now exports more frozen vegetables than Belgium, the previous top exporter.

Higher costs all around

In 2021 and 2022, the cost of making and shipping processed vegetables also increased due to higher prices for vegetables, packaging, logistics, and energy. Inflation affected the fresh vegetable sector too, though to a lesser extent.

“The most notable trend in recent years has been cost increases, resulting in higher trade value as well as increased prices in the supermarket,” says Van Rijswick. “In many cases, prices also increased for consumers. Despite inflation, consumption has held up relatively well overall. Still, it is difficult to determine whether inflated vegetable prices have impacted consumer purchasing behaviour, as developments vary around the world.”

In Australia, for example, per-capita vegetable consumption decreased between 2017 and 2022, despite relatively limited inflation, as consumers shifted to purchasing fewer, but higher-value vegetables.

In the US, the overall volume of vegetables consumed did not change much over the same period. German households, in contrast, bought more fresh vegetables, with post-pandemic purchases remaining considerably higher than in 2019, despite the relatively high increase in vegetable prices.